Marketing & Sales

2025: The Year Homebuilders Prove Who They Really Are, And Can Be

2025 isn’t just about adapting to a land-light, asset-light model — it’s about proving whether you can sustain growth if buyers pause. With insights from NAHB’s latest data, we reveal the real challenge: outpacing rivals and building trust in a high-risk, high-stakes market.

For U.S. homebuilders, the Spring Selling Season 2025 getting underway now is not just another sales cycle.

It’s a litmus test of their operational adaptability and business resilience. The traditional market forces of supply, demand, pricing, and mortgage rates are now intersecting with a strategic pivot: the industry-wide shift to an asset-light, land-light model.

This operational transformation demands three interdependent successes:

- Strong pull — a steady pace of new home orders.

- Consistent push — predictable, highly efficient velocity in end-to-end construction cycle times.

- Vacant-developed lot pull — a reliable flow of vacant developed lots to sustain production.

Any disruption in this system — whether caused by demand shortfalls, cost inflation, or supply-chain inefficiencies—can introduce existential risk to even the strongest operators.

A Market in Flux

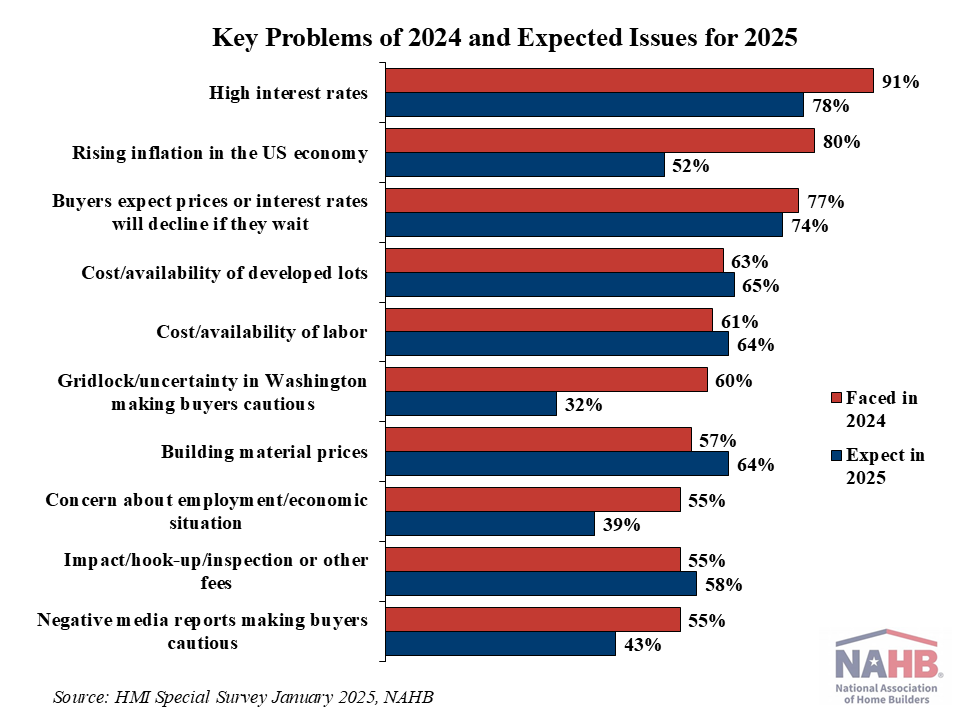

Data from the National Association of Home Builders (NAHB) reveals a stark reality: the top three challenges that shaped 2024 remain dominant concerns heading into 2025.

- High interest rates – 91% of builders cited them as a challenge in 2024, and while fewer (78%) expect them to be as severe in 2025, they remain the most significant barrier.

- Rising inflation in the U.S. economy – A concern for 80% of builders in 2024, though slightly less of a worry in 2025 (52%).

- Buyers expect prices or interest rates to decline if they wait – This psychological factor impacted 77% of builders in 2024 and remains a concern for 74% in 2025.

NAHB senior economist Ashok Chaluvadi writes:

The most significant challenge builders faced in 2024 was high interest rates, as reported by 91% of builders in the latest NAHB/Wells Fargo Housing Market Index survey. A smaller, albeit still significant share of 78% expect interest rates to remain a problem in 2025. The next four most serious issues builders faced in 2024 were rising inflation in the U.S. economy (80%), buyers expecting prices/interest rates to decline (77%), the cost/availability of developed lots (63%), and the cost/availability of labor (61%). Builders don’t expect much improvement in these challenges in 2025, except for rising inflation, which ‘only’ 52% see as a serious problem in the year ahead."

These forces create a confidence gap among potential buyers, many of whom believe waiting will yield better affordability. This uncertainty is not an isolated phenomenon; it’s happening at the very moment homebuilders are reengineering their business models toward leaner operations that demand predictability.

The Risk of Mismatched Timing

For decades, large and mid-sized homebuilders relied on a model of owning land outright, absorbing fluctuations in demand, and timing sales cycles to mitigate risk. That playbook is being rewritten. The pivot toward off-balance-sheet land strategies—which emphasize purchasing lots only as needed—lowers financial exposure but raises operational vulnerability.

Success depends on a steady, predictable sales pace. But what happens when buyers hesitate?

A builder can only manage an asset-light system if:

- Sales velocity remains steady.

- Construction cycle times are predictable.

- Developed lots flow into the system without costly disruptions.

The NAHB survey underscores a troubling pattern: while builders recognize demand-side pressures, their ability to influence buyer confidence remains limited. If Spring Selling Season underperforms, the delicate balance of pull, push, and land acquisition could unravel for some operators.

Beyond Interest Rates: The Operational Gauntlet

While interest rates dominate headlines, a second tier of business challenges threatens profitability:

- Cost and availability of developed lots (65% in 2025, up from 63% in 2024)

- Cost and availability of labor (64% in 2025, up from 61% in 2024)

- Building material prices (64% in 2025, up from 57% in 2024)

Despite inflation showing signs of easing, builders anticipate higher lot, labor, and materials costs. These are not temporary hurdles; they directly threaten the efficiency required for a land-light model to function.

Even the most disciplined financial management strategies can crumble under the weight of production delays, fluctuating input costs, and unpredictable consumer behavior.

The Affordability Choke Point

The root cause of uncertainty in 2025 is clear: affordability.

- High home prices.

- Rising mortgage rates.

- Escalating insurance and property tax burdens.

- A declining pool of income-qualified buyers.

It’s not just that some potential homebuyers are being priced out—it’s that many who can afford to buy are choosing not to. That hesitation alone threatens the foundation of the homebuilders’ evenflow model.

Why Consumer Confidence Matters More Than Ever

NAHB’s data also highlights psychological barriers among buyers. A full 74% of builders say potential buyers believe home prices or interest rates will decline—meaning many are waiting rather than committing.

This is a dangerous dynamic for a business model that relies on momentum, backlog, and consistent pull-through of sales.

The traditional builder playbook—offering mortgage rate buydowns, incentives, and flexible financing—is still being used, but the question is: Will it be enough?

The Ultimate Challenge: Who a Builder Is vs. What They Do

The homebuilding industry is not just defined by what it produces—it’s defined by who builders are and how they respond to adversity.

That distinction matters because 2025 is shaping up to be a proving ground not just for new business models, but for leadership.

Consider the lessons of resilience from Atlantic Builders. The Virginia-based builder has demonstrated that a commitment to long-term relationships, community investment, and organizational integrity can sustain a business through volatility. Their "Give Back Home" program has contributed over $3.8 million to charitable causes over eight years—not as a PR initiative, but as an embedded cultural value.

As Atlantic Builders’ CEO Adam Fried put it:

We’ve always tried to do good things… and I think we started seeing that we were really doing well. Economy was humming."

His perspective underscores a critical truth: Builders who establish deep community ties, strong trade relationships, and trust-based leadership structures are better equipped to handle uncertainty.

2025: A Year That Will Reveal the Future of Homebuilding

NAHB’s data makes one thing clear: homebuilders know their challenges.

What remains unknown is how many will successfully navigate them.

- Will Spring Selling Season deliver the backlog necessary to stabilize the new land-light model?

- Will homebuilders manage cycle times and construction efficiency in the face of rising costs?

- Will they build trust and urgency among hesitant buyers—or suffer through another year of uncertainty?

For many, the difference won’t just be operational competence—it will be identity. The firms that thrive in 2025 and beyond won’t just be those that build efficiently—they’ll be the ones that build trust.

The shift to an asset-light model isn’t just a financial decision. It's not just about performance; it's about outpacing competitors of all stripes. It’s a cultural and strategic commitment that will require a recalibration of priorities. The companies that adapt fastest—those that understand it’s not just about what they do, but who they are—will be the ones that define the next era of American homebuilding.

For the rest, the risk isn’t just volatility—it’s obsolescence.

MORE IN Marketing & Sales

How Homebuilders Can Fix Broken Buyer Conversion Now

New Home Star’s Chris Laskowski breaks down what’s stalling new home conversions in today’s market—and what to do about it. From weak webpages to ignored AI search, he lays out a builder’s to-do list for turning traffic into buyers.

Do Homebuilders Waste Money On Marketing No One Trusts?

To build rapport with buyers, homebuilders need to be upfront, shift from selling to educating, and evolve their marketing strategies. Marketing strategist Barbara Wray shares time- and cycle-tested secrets.

Research: Supply Constraint Is Not No. 1 Driver Of Housing Crisis

Findings imply that constrained housing supply is relatively unimportant in explaining differences in rising house prices among U.S. cities -- suggesting that easing housing supply constraints may not yield the anticipated improvements in housing affordability.