Marketing & Sales

2024's Top 10 New Trends In Homebuilding: No. 4 Price Drops

Success – homebuilding, and residential development senior strategists and principals must consider as a better-than-expected 2023 winds down – may be the enemy.

Success – homebuilding, and residential development senior strategists and principals must consider as a better-than-expected 2023 winds down – may be the enemy.

Why? Success can be fleeting, or it can be a mirage, or it can come back to bite you, or it can lull you into complacency.

Homebuilding operators saw wins in 2023. These were notched by pulling adequate streams of new buyer revenue in to feed their machines, capture time back on their build-cycles, remove land carrying costs, service debt, and shoulder local and corporate overheads. These builders met or exceeded goals set in a deteriorating budget planning cycle a little over a year ago.

The success of mortgage buydowns, keeping many of the nation's enterprise-level homebuilders' absorption paces ticking along in the face of higher and higher Fed-driven interest rates this year counts as one of 2023's tactics of the year, sparing many an operator an otherwise rough time of it.

With captive lenders joined at their hip, builders managed to spark pace by using financial accounting to bridge the gap spooling 30-year fixed mortgage rates. This helped prospective buyers lower their monthly payment.

Those programs worked. To varying degrees, they got builders out of a tactical bind of sales air pockets and standing inventory and, possibly even land impairments hitting their books. They kept the lights on, the bills paid, and the work moving forward.

But, what they didn't solve is the root cause issue, partially because they worked so well to mitigate the worst of the symptoms.

The root cause issue is a decoupling of household incomes and new home prices, paired with generationally high mortgage interest rates.

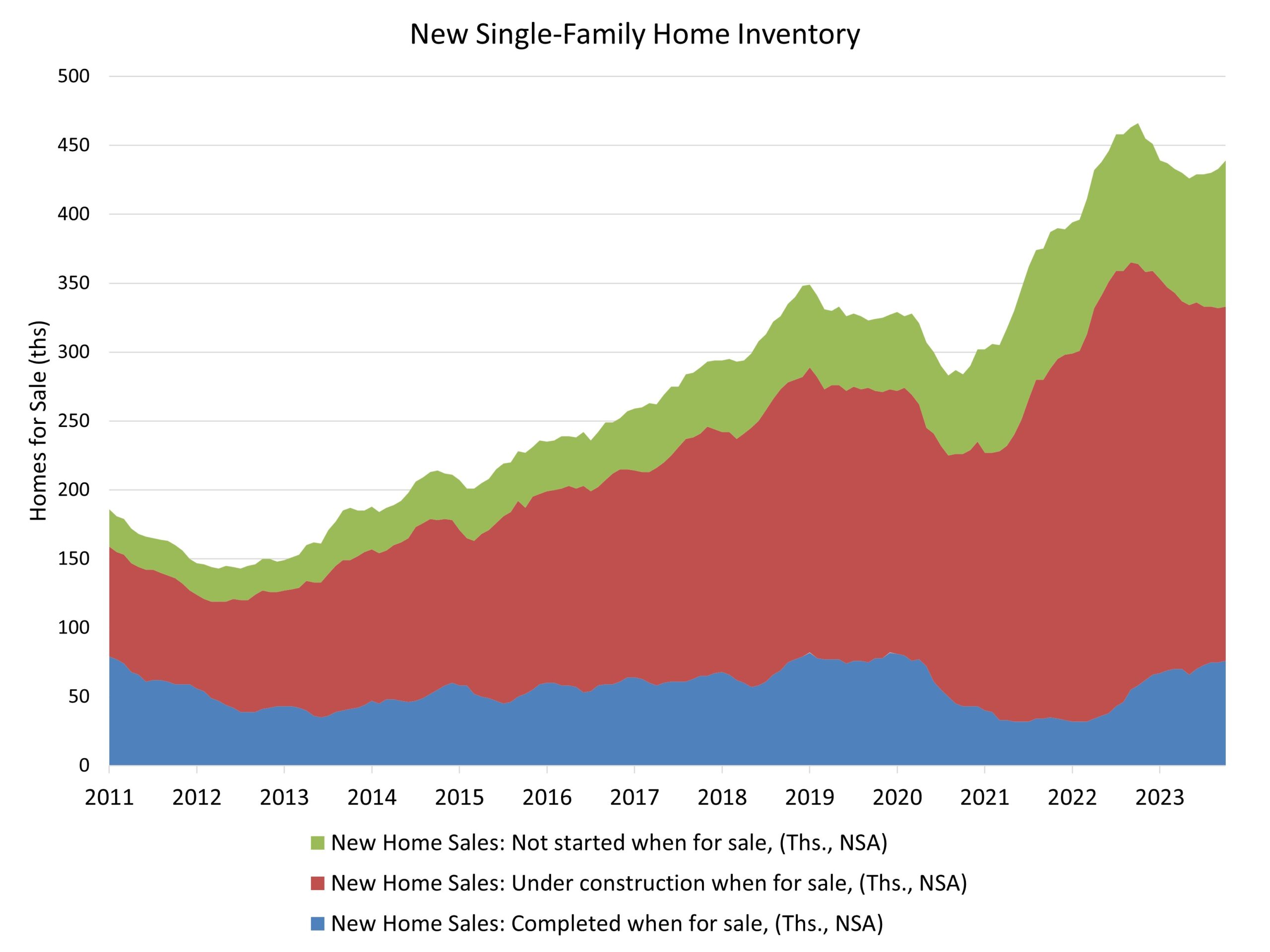

The underlying problem remains the underlying problem. The housing shortage persists. High borrowing costs have intensified it, because so many developers and home builders take out loans to complete their projects. Until housing production ramps up for an extended period of time, until there’s considerably more supply relative to demand, things are not going to feel good. They can’t." – Annie Lowrey, The Atlantic

A structural solution vs. a tactical workaround, some say, would mean more homebuilders leaning their shoulders into an array of time-tested disciplines – hidden in plain sight – to further bend their own cost curves to a level more working households striving for the dream of homeownership could make a reality.

In their way, however, is this extended period of success built on buydown tactics, which according to New Home Star founder and CEO David Rice may be the enemy.

The pricing on new homes is where the interesting story is, which is in how new home products are priced relative to household wages and true buying power," Rice says. "It's priced out of the market. The market is too high for affordability."

The problem, Rice asserts, will remind industry veterans of an era most would rather forget forever in the sense that builders' 2023 sales catalyst tactics may be successful, but they more than likely are unsustainable.

Builders have enough room in their margins that they've been able to buy down the interest rate all year," Rice notes. "They have met sales goals and kept sales pace by making financial moves that shift money from builders' margins into financing incentives for buyers.

That way, they engineer a cost of ownership. The buyer is willing to pay a higher price because a builder offers them a lower monthly payment. That's what's happened this whole year."

The grave misstep, Rice believes, would be for operators to bake these tactical measures in as sales strategies, and to do the harder, more rigorous, and more fundamentally strategic work of bringing their entire ecosystems' cost structures downward, more genuinely within reach of young, striving households. Rice adds that the best home builders his teams interact with have worked tirelessly to lower their costs with smaller plans and improved engineering, but that whole process takes longer and there's not enough room in margins to have the same impact on pricing as can be accomplished by buying down rates.

You could say this [better-than-expected year] is a setup," Rice notes. "You could argue that there's another story that the markets will one day reflect on and say, ‘Well, gosh! We all should have known that wasn't going to last.' And the story is, the home prices aren't affordable. For the most part, builders aren't selling houses right now except where they're buying down interest rates to make those prices affordable. That's what should challenge us the most. New home prices are inflated above what's affordable. Affordability needs to be addressed throughout the homebuilding ecosystem and not just in a way that combats increased mortgage rates."

Not to mention a mark-to-market property value comeuppance awaiting at least some of the homebuyers priced-in to these homes thanks to a mortgage buydown.

The moment that this buyer, who, for example, could actually only afford $350,000, but paid $400,000 has to sell, they won't find a buyer when they're a seller two years from now," Rice says. "They don't have the ability to buy down anyone's rate. They're just not in such a position and the next buyer without the advantage of that rate incentive will find this price still not affordable. This person buying right now is then really badly stuck. That might mean $50,000 upside down on their purchase."

Opportunity – under these circumstances – will go to homebuilders who build trust and referral equity as the market comes to a next new normal later in 2024 or in 2025.

Meanwhile, new home prices have to keep coming back to within reach of a cost-of-living squeeze buyer universe. Today's New Home Sales data from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau notes they're already heading in the right direction. National Association of Home Builders chief economist Robert Dietz writes:

The median new home sale price in October was $409,300, down 3.1% from September, and down 17.6% compared to a year ago. Pricing is down both due to builder incentive use and a shift towards building slightly smaller homes. As a result, 33% of sales were priced between $300,000 to less than $400,000, compared to a year ago when just 20% of sales were in that range."

There's still a lot of work to do, asserts New Home Star's David Rice.

The industry cycle is past the mid-point of a switch from a seller's market to a buyer's market," cautions Rice. "I hope will see leaders of these firms keep truly ahead of this swift tightening up in the market with their business and operational strategies, and through rigor, training, and product development, they'll be the ones who'll survive and thrive in the coming downturn."

MORE IN Marketing & Sales

How Homebuilders Can Fix Broken Buyer Conversion Now

New Home Star’s Chris Laskowski breaks down what’s stalling new home conversions in today’s market—and what to do about it. From weak webpages to ignored AI search, he lays out a builder’s to-do list for turning traffic into buyers.

Do Homebuilders Waste Money On Marketing No One Trusts?

To build rapport with buyers, homebuilders need to be upfront, shift from selling to educating, and evolve their marketing strategies. Marketing strategist Barbara Wray shares time- and cycle-tested secrets.

Research: Supply Constraint Is Not No. 1 Driver Of Housing Crisis

Findings imply that constrained housing supply is relatively unimportant in explaining differences in rising house prices among U.S. cities -- suggesting that easing housing supply constraints may not yield the anticipated improvements in housing affordability.