Policy

2022: The Year Homebuilders Must Re-secure Their Build Cycle

In spite of ongoing supply chain disruptions, builders need to regain predictability over their start-to-completion schedules to restore an operational model to build on.

People who make livelihoods, firms, sustainable-profit-making enterprises, and fortunes in the business of putting up homes and igniting communities have time for neither hope nor despondency as stars that were aligned until recently now tug apart, into their own separate celestial lanes.

As far as this population is concerned, a bear market on Wall Street and a cost-of-living crisis on Main Street occupy spheres that relate to but don't make or break what they do, which is to profitably make places to live that are worth more than it costs to bring them to market, and then become worth even more than that.

That's simple to say and hard to do on a good day.

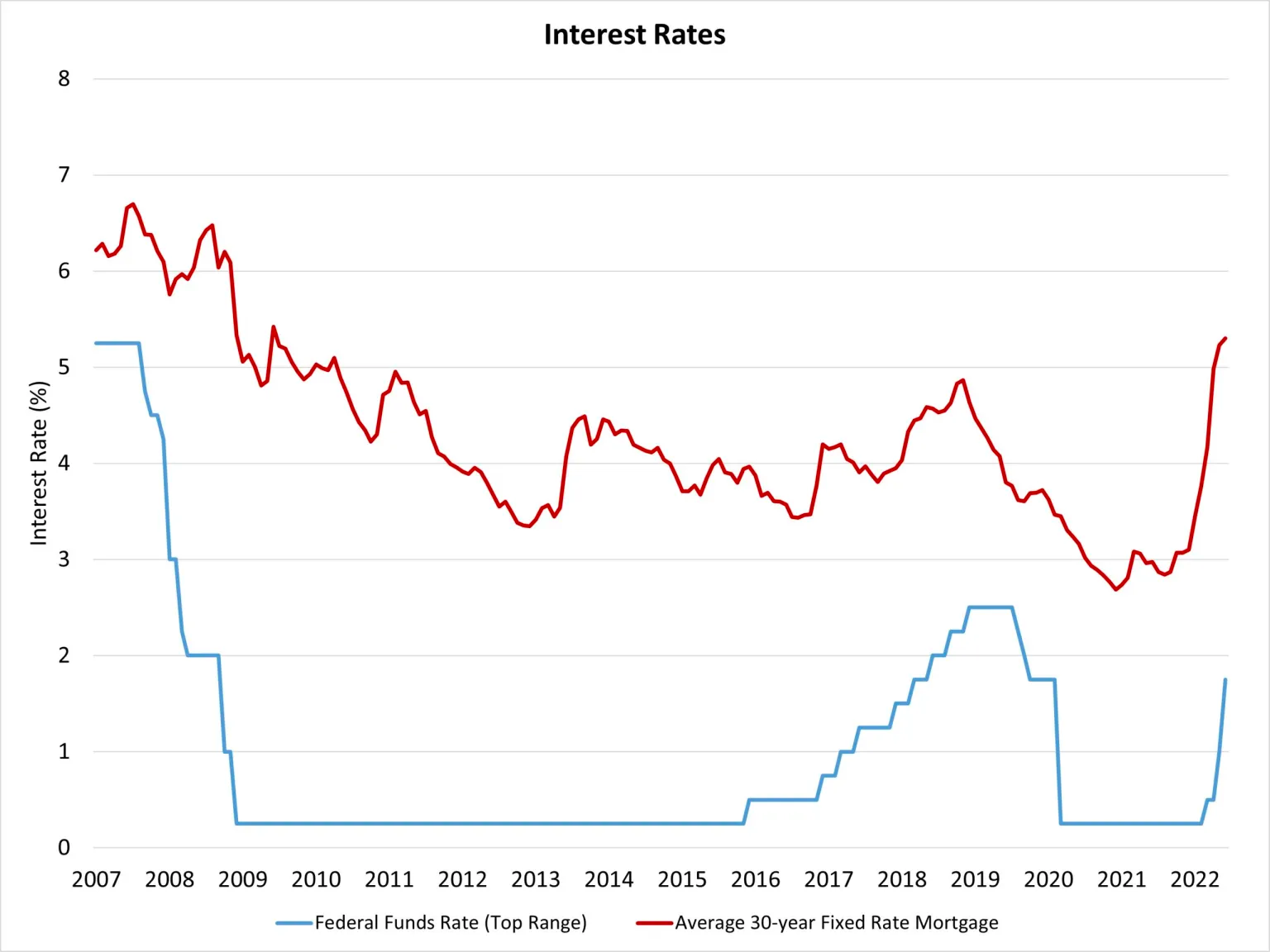

Now, worth and cost are in flux, partly because what people bring home in pay is under assault by more factors that are tracking as higher expenses every day, and partly because money they used to access to pay for more valuable, durable things over time is also bound on a curve at odds with their means.

The bottom bottom bottom line is that only more, many more, new homes – for-sale, for rent, single-family, multifamily, attached, detached – can fundamentally ease a core component of consumer inflation.

Bloomberg's Conor Sen notes:

It's true that inflation is too high and demands a policy response, and the housing market was unsustainably hot, with home prices and mortgage rates combining to create extreme affordability challenges. So it makes sense to raise mortgage rates to help cool off both inflation and the housing market.

The concern comes when we realize there is a wave of tens of millions of millennials who will be looking to buy homes over the next decade. The housing market needs the construction of many more homes to meet that demand. If we’re already constraining economic activity so much that it's leading to job losses, that will make it more difficult to ramp the machine back up after inflation is under control.

And National Association of Home Builders chief economist Robert Dietz writes a complementary view of the double-bind housing businesses find themselves drawn into:

Elevated inflation readings call for a normalization of monetary policy, particularly as the economy moves beyond covid-related impacts. However, fiscal and regulatory must complement monetary policy as part of this adjustment. Yet, many of these measures are simply beyond the Fed’s control.

For example, higher inflation in housing is due to a lack of rental and for-sale inventory and cost growth for building materials, lots and labor. Higher interest rates will not produce more lumber. A smaller balance sheet will not increase the production of appliances and materials. In short, while the Fed can cool the demand-side of the economy (reducing inflation and growth), additional output on the supply-side is required in order to tame the growth in costs that we see in housing and other sectors of the economy. And efficient regulatory policy in particular can help achieve this goal and fight inflation.

Now, here is part – say, year one of the next few years – of the scenario for an inflection in the supply, demand, and prices axis. It comes from Calculated Risk host and analyst Bill McBride. Bill's estimate is that, all things being equal, 1.7 million new single- and multifamily homes are somewhere in construction's build-cycle due for completion in 2022. That would amount to a bumper crop of new home construction not seen since 2006.

As to the economic impact adding that bumper to current housing stock, McBride has this to say:

Clearly with weakening demand, and more new supply (and increasing existing home supply), house price growth will slow sharply.

What's not a given though is this, and this is where builders and their manufacturer, developer, land, and distributor partners have a job to do that's going to take all they learned in the past 14 or 15 months to overcome supply chain hurdles and put it to work in this trailing 12 month period.

What they can't afford to do is to lose on both the capability to flow through their construction cycle in the smartest, most efficient, most disciplined way – i.e. capture back the cost they lost in time – and the pulse of demand.

Margin opportunity is there to seize – in time and energy and operational excellence savings, and a big part of that will be in super motivating team members to pull together to re-take control of the build cycle.

Even amidst ongoing snags, chokeholds, and disruptions due to the Ukraine War, and to weather, and to the malingering effects of the pandemic, the build cycle schedule is a non-negotiable for a company to steady itself, and refocus on the portion of would-be buyers who can count themselves undeterred by financial headwinds right now, and lay that demand group as a foundation to build on.

This does not come down to policy. It comes down to culture, and company craft, and leadership.

A big part of that – in this moment of truth for homebuilding companies to leverage capability to resecure their build-cycle – is turning to trusted building trades, ones who'll look at the next couple of years as a litmus test of what homebuilders will be like as partners when there's a stretch ahead that's not all about scarce supply and gigantic demand.

A $1 trillion federal infrastructure program is about to kickstart into motion, estimated to draw up 825,000 jobs by 2025, many of them construction jobs who'll likely be people who have an option to work on one of those thousands of new projects or work for your homebuilding firms.

Here's an example of the lengths some industry members are going to proactively take care of the people who are the future of their ability to survive and thrive through to the next upturn in the economy and housing.

Central Florida Transport, one of the state’s largest aggregate haulers, created a full-time driver advocate position to help its truck drivers with tasks that are tough to do during a busy workday, such as scheduling healthcare appointments or finding a loan broker.

“We wanted to do whatever possible to help solve their problems because we can’t afford to lose any drivers,” said Myron Bowlin, the company’s vice president.

Builders, too, can't afford to lose any [fill in the blank]. Both to complete those 1.7 million new single- and multifamily homes to start tipping the scales on ownership and rental price inflation, and to remain on the beam – equidistant from hope and despair – builders need to secure capability to build through this tough time no matter what happens on the policy, the Wall Street finance, or the Main Street consumer confidence and behavior front.

Join the conversation

MORE IN Policy

Texas Treads A New Path Into Zoning To Battle Housing Crisis

Texas is one of the nation's most active homebuilding states, yet affordability slips out of reach for millions. Lawmakers now aim to rewire the state’s zoning laws to boost supply, speed up approvals, and limit local obstruction. We unpack three key bills and the stakes behind them.

Together On Fixing Housing: Solve Two, Start the Rest

NAHB Chief Economist Robert Dietz and Lennar Mortgage President Laura Escobar argue that the housing crisis won’t be solved by magic. It starts with a unified focus on two or three priorities—a rallying cry for builders, developers, lenders, and policy-makers.

Zone Offense: North Carolina Moves To Fast-Track By Right Housing

North Carolina legislators are pushing a bipartisan bill that could fast-track housing where people need it most: near jobs and transit. Richard Lawson breaks down what it means, how it compares to other states’ moves, and why developers are watching closely.