Land

$100M Purchase Of Gulf Coast's Truland Homes Ups M&A Ante

With the acquisition, D.R. Horton deepens an already entrenched and expansive local scale, and gets a big bump up in market share in one of the nation's 10 hottest pandemic era domestic migration magnets.

D.R. Horton – America's leading homebuilding organization and its most profitable one -- announced this morning it has acquired Alabama-Florida Gulf Cost private homebuilding market leader Truland Homes for about $100 million.

Here's the data on the asset acquisition, provided in a press statement:

- approximately 263 lots, 155 homes in inventory and 55 homes in sales order backlog;

- also, 156 lots and control of approximately 400 lots through option contracts from Truland affiliates; and

- 201 lots and control of approximately 260 lots through option contracts from third parties.

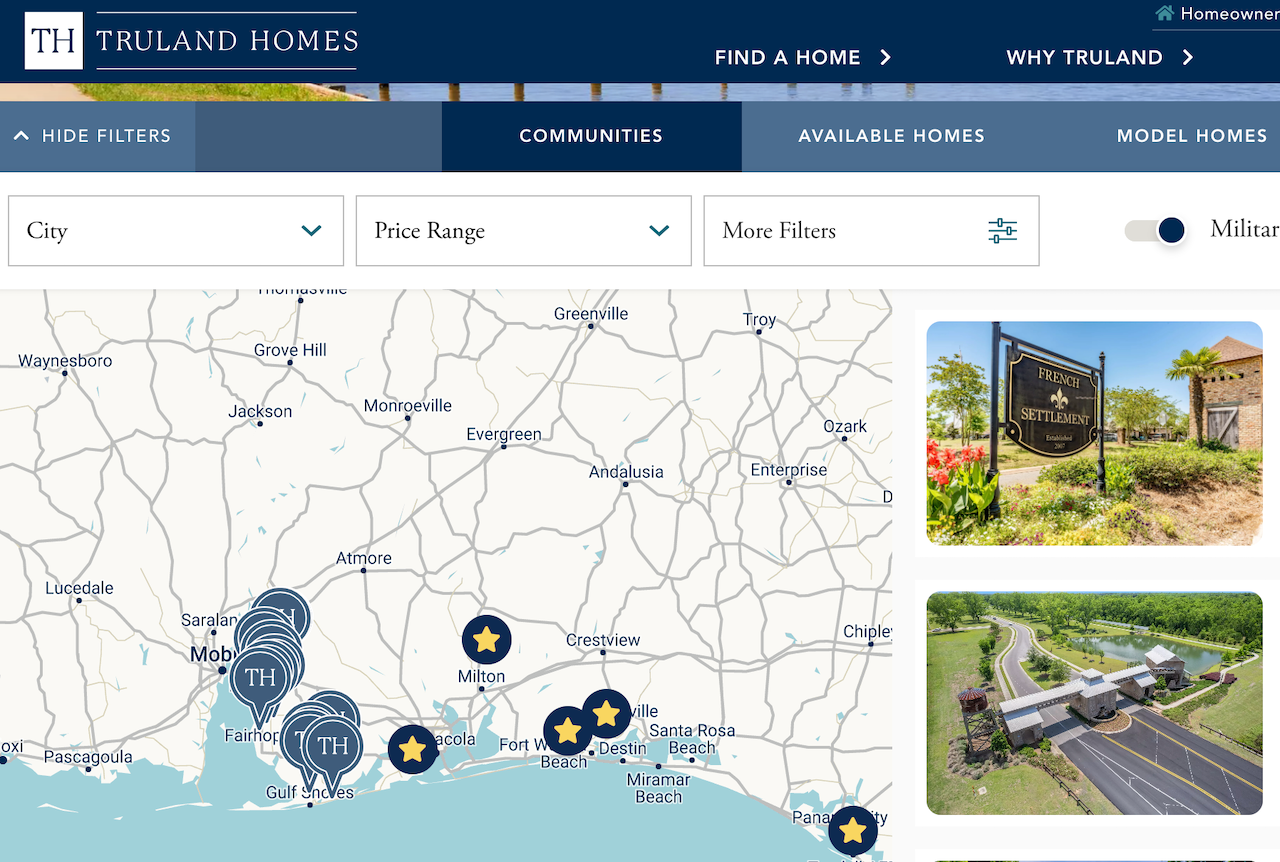

Truland – which recorded $244 million in 2022 revenue on delivery of 512 homes last year -- got its start in Spanish Fort, Alabama, in 2011. It was founded by serial entrepreneur and real estate developer Nathan Cox, the company principal up to the transaction's effective date.

With the acquisition, D.R. Horton deepens an already entrenched and expansive local scale, and gets a big bump up in market share in one of the nation's 10 hottest pandemic era domestic migration magnets – an area with appeal on both quality of life and affordability axes, economic and job growth, as well as a steep demand vs. existing home supply imbalance.

Horton, consistent with a Sam Walton-style approach to its signature "America's Builder" tagline, has regarded its well-rooted dominance in Alabama and the Florida Panhandle as part of its primary-, secondary-, and tertiary-market strategic DNA. Truland founder Nathan Cox notes that his real estate acquisition and development interests through the years have served as "the largest lot supplier within their Gulf Coast region." According to the release, Cox plans – following the close of the deal – to continue to work with the D.R. Horton machine in the region as a land and lot development partner as part of his ongoing real estate entrepreneurial ventures.

A prepared comment from D.R. Horton chairman Donald R. Horton, notes:

We are excited for the Truland team to join the D.R. Horton family. Their quality building operations and strong presence across the Gulf Coast make Truland a great addition to D.R. Horton’s already strong local market operations.”

The nation's No. 1 builder had virtually no national homebuilding operator competition until 2017, when Clayton Homes acquired Birmingham-Montgomery, AL-based Harris Doyle, as part of its national site-built operator portfolio.

Lennar, also active particularly in the coastal areas of the state, quietly picked up the Breland Homes assets of Huntsville, AL-based Breland Companies, a residential and commercial land developer, in late Winter 2022. At the time of the Lennar-Breland purchase, we wrote:

At a high level, the sale pairs a multi-regional 33-plus-market enterprise striking at an opportunity for fast-growing current, near-future, and long-haul volume, area operational capability, and deeper clustered-market scale in across Georgia, Florida, and now Alabama with a multi-time "rinse-and-repeat" homebuilding mini-empire builder with operational and land strategy chops that prove to span good parts of the housing cycle and not-so-good." The Builder's Daily

Alabama, particularly in the counties Truland operates in, has been an outlier since the 2020 onset of Covid-19, riding an in-migration wave of home-seekers looking for remote work destinations that offer a high quality of life and relative affordability that can make shelter dollars go farther.

According to a late-2022 piece in American Law:

People are moving to Alabama in larger numbers than the state has seen in at least a decade, and it’s helping to boost Alabama’s population in a time where the state continues to see more deaths than births.

New population estimates from the U.S. Census Bureau show Alabama gained almost 25,000 people from July 1, 2021 to July 1, 2022. But the state added more than 33,000 people through migration during that same year, meaning new arrivals made up for an otherwise shrinking population."

The D.R. Horton-Truland acquisition follows by a few weeks the quietly completed purchase of Boise, ID-area Hubble Homes by Sekisui House-owned Woodside Homes, suggesting a busier period ahead for homebuilder mergers and acquisition activity in the back half of 2023.

We're working with more than a handful of homebuilders on the sell-side process in markets like the Carolinas, Florida, Texas, and the Mountain States," Tony Avila, CEO of Builder Advisor Group, a The Builder's Daily sponsoring partner. "There's really strong interest and bids among potential buyers active today's market."

Avila notes that strategic acquirers – U.S.-based national public and regional private homebuilding enterprises, Asia- and Canada-based global residential real estate and construction firms, as well as a few Europe-based investor groups – have stepped up purchase efforts after a stronger-than-expected first-half on both home sales volumes and pricing, and hence, profitability.

The public and stronger private homebuilders have got a lot of cash, and they're looking to guide for growth in volume and margins," Avila says. "The interest level is very high where there's been population growth, jobs growth, and quality of life magnetism all of which have run in contrast to a restrictor plate weighing on supply, where it's taken longer to build new homes and there are fewer existing homes listed for sale."

Avila expects a marked pick-up in M&A activity in the weeks and months ahead – especially among strategics – owing, in large part, to predictable incremental volumes and forecast run-rates that an acquisition can reliably deliver. Margin improvement opportunity also comes with the turf as experienced acquirers integrate their new family members into already established operating groups, conserving costs and optimizing marketing and sales resources.

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.