Leadership

As Housing Challenges Mount, The Throes Of Opportunity Call

In a focus on housing's role in the decline of overall financial well-being, Fed analysts framed three of their insights around homeownership and mortgages, where both the severity of the challenge and the ripeness of opportunity jump out.

Opportunity in housing is its severest challenges inside-out. The space and the moment are full of them.

This applies in many domains. Let's look briefly and narrowly at one example, in homeownership and mortgages, where a cost-of-living crisis hits different households differently based on a wide range of incomes.

The Federal Reserve checked in recently on household financial well-being. The headline data – a rollup of self-reported survey responses across an array of non-negotiable household ledger items – signals a red flag.

...Self-reported financial well-being fell sharply and was among the lowest observed since 2016. Similarly, the share of adults who said that they spent less than their income in the month before the survey fell in 2022 from the prior year, while the share who said that their credit card debt increased rose."

Among those non-negotiable household ledger items in the Federal Reserve's pulse on financial well-being, housing got its own line of focus.

At a high level, findings of the survey fail to spell out whether the 7-year low point in overall household financial well-being means that households have lost ground when it comes to their housing choices and wherewithal. One of the key findings states explicitly that rent-by-choice vs. rent-by-financial-necessity levels are roughly comparable with pre-pandemic trends.

However, the report notes that by late-Spring 2023, some share of renters – who make up about 27% of households – reports they're having difficulty keeping up payments, and 17% report that they're falling behind in the prior 12 months.

That's about 6 million people renting their homes who are falling short due to the full brunt of the nation's cost of living and economic disruption.

Inflation is hitting households in their pocketbook, and it's starting to impact spending and dampen confidence:

- Morning Consult reports: Real spending decreased by 1.3% in April following a sharp decline in March and a slowing of momentum in February. Spending for services, durable goods and nondurable goods have all seen monthly declines in Morning Consult’s data, which is often directionally indicative of what to expect from the Bureau of Economic Analysis’ Personal Consumption Expenditures report.

- Meanwhile, The Conference Board today reports that its Consumer Confidence Index fell to 102.3 in May, down from a revised 103.7 in April: The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—decreased to 148.6 (1985=100) from 151.8 last month. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—decreased slightly to 71.5 (1985=100) from 71.7. The Expectations Index has now remained below 80—the level associated with a recession within the next year—every month since February 2022, with the exception of a brief uptick in December 2022.

So, the Fed's household financial well-being analysis is not alone as it tracks a growing sense of gloom among consumers.

In a more expansive focus on housing's role in the decline of overall financial well-being, Fed analysts framed three of the study's insights around homeownership and mortgages, where both the severity of the challenge and the ripeness of opportunity jump out.

(1) Homeownership across income levels

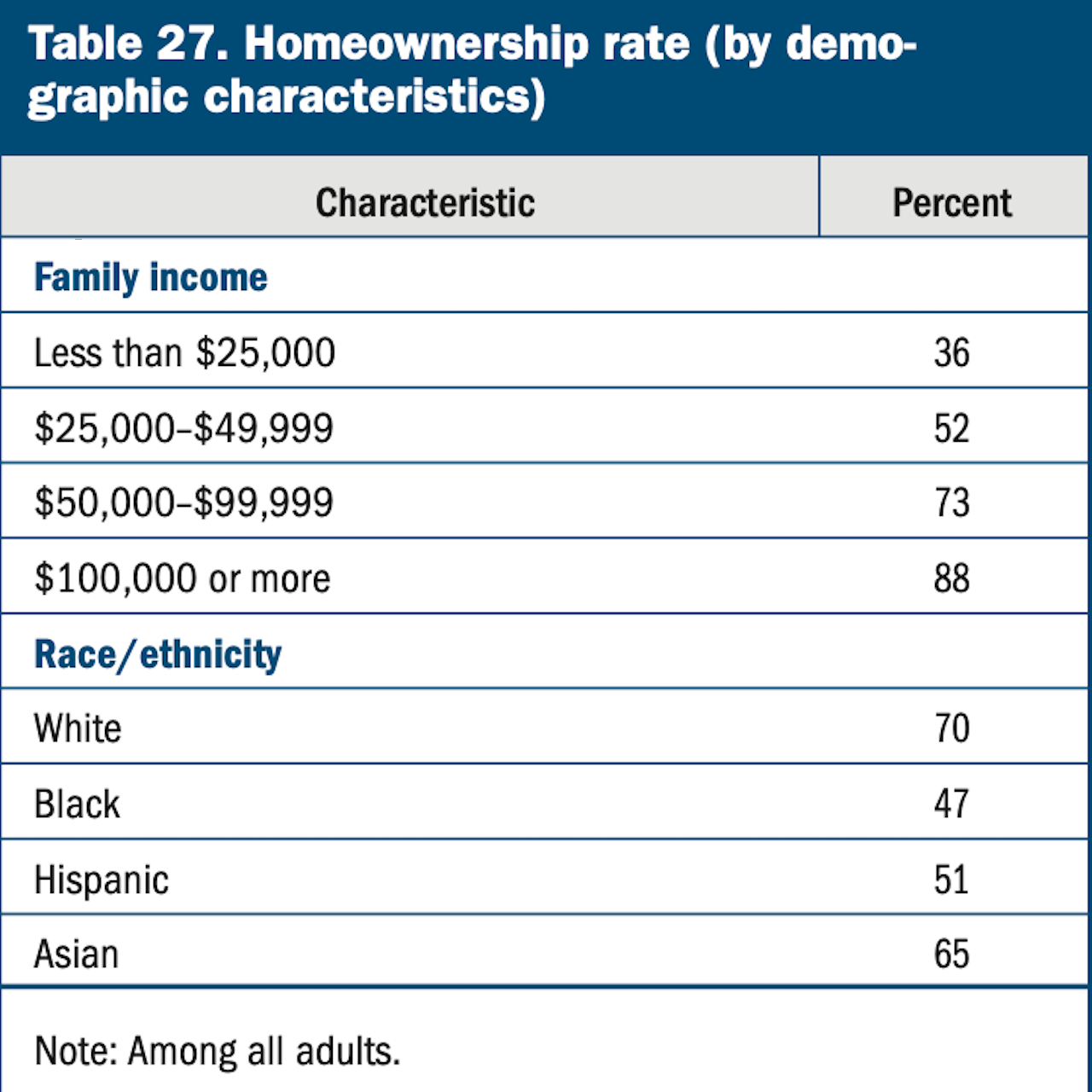

Sixty-three percent of adults owned their homes. Yet, the likelihood of owning varied substantially across demographic groups. Nearly 90 percent of adults with a family income of $100,000 or more owned their home, compared with 36 percent among those with less than $25,000 in income. Differences were also present by race and ethnicity, even among those with higher income (table 27).

(2) Median Mortgage Payment

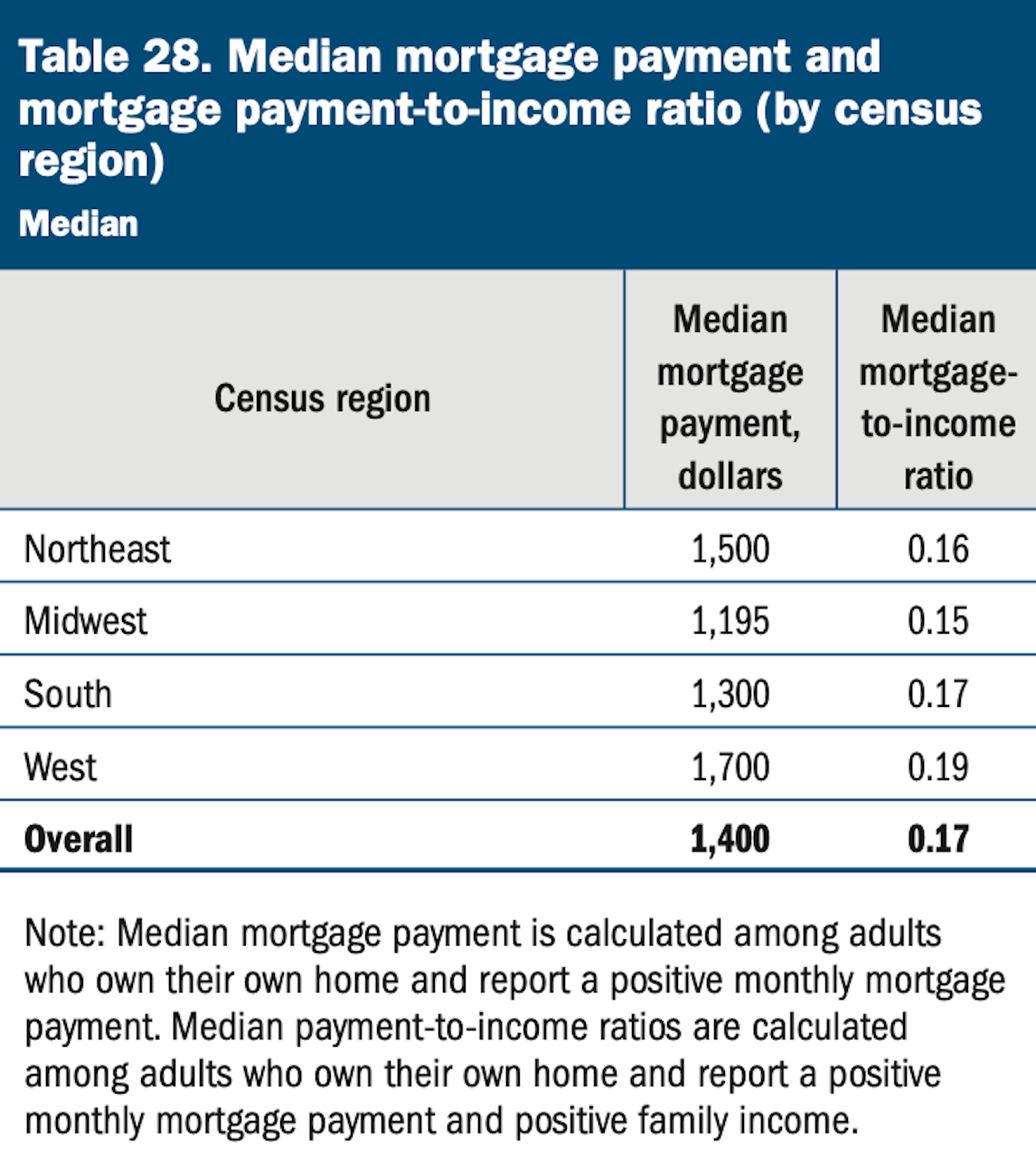

Nearly two-thirds of adults who owned their home had a mortgage in 2022. The median monthly mortgage payment was $1,400 (table 28).35 Mortgage payment amounts dif- fered across census regions. Mortgage payments were higher in the Northeast and West, compared with the Midwest and South."

(3) Median Percentage of Income on Mortgage Payment

The median share of family income that homeowners with a mortgage spent on their mortgage payment was 17 percent. Differences across census regions in the median mortgage payment-to-income ratio were smaller compared with mortgage payments, as the median mortgage payment-to-income ratio helps to account for regional differences in cost of living."

In each of these three data sets nests both a measure challenge – i.e. only a little over a third of homeowners are in households with income of less than $25,000 – and its inside-out opportunity for a community of solutions finders to rise above it.

Falling confidence, cost-of-living crisis cuts in spending plans, and growing unease over personal financial conditions may not look like business opportunities, but unmet needs – especially the glaring ones — are where ground-up builders, developers, designers, and investors together have some of the decade's biggest chances to thrive. The good news is you don't have to look far in any direction to see and feel them. They're everywhere and multiplying.

MORE IN Leadership

We Salute Donald R. Horton, Founder Of 'America's Builder'

Through his career, his customers, his team member associates, his shareholder investors, and, by and large, an ecosystem of business partners, local community stakeholders, etc., learned that D.R. Horton was, is, and will be synonymous with winning.

Four Teams Win The 2024 Ivory Prize For Housing Affordability

A competition in its 6th year celebrates the work of innovative organizations making an impact in housing affordability in three areas of focus: construction and design, finance, and policy and regulatory reform.

Millennial And GenZ Buyers Drive 60% Of Home Purchases

Here’s how homebuilders and their partners team up to solve for both the math and the psychological challenges with tech when digital natives want it, and people when they need them.